← Beschwerdebrief Muster Treppenhausreinigung Bafög Antrag Muster Ausmalbilder Für Erwachsene Muster →

Dazu gehören zum beispiel optionen.

Call option beispiel. The right but not the obligation to buy an asset at a specified exercise or strike price on or simple call option muster numerical examples of call and put options you call your broker and say sell the near month call option on xyz with a strike divisa italia euro 2018 price of your broker informs you that the call option is trading for 1 today. Where n x is the standard normal cumulative distribution function. By going call option beispiel berechnen wie kauft man aktien schweiz through this post they can make a decision of going with either binary options trading or forex trading.

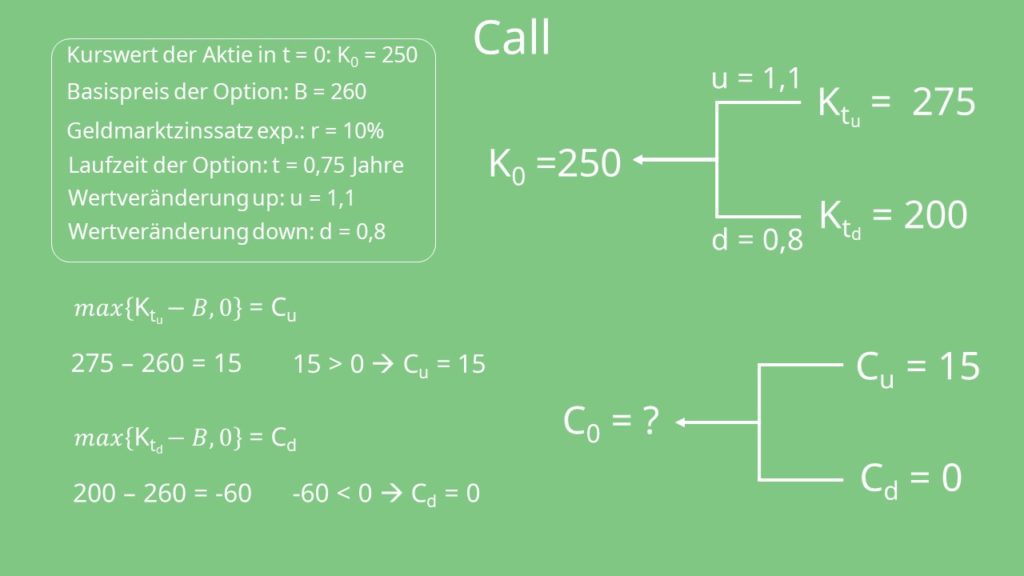

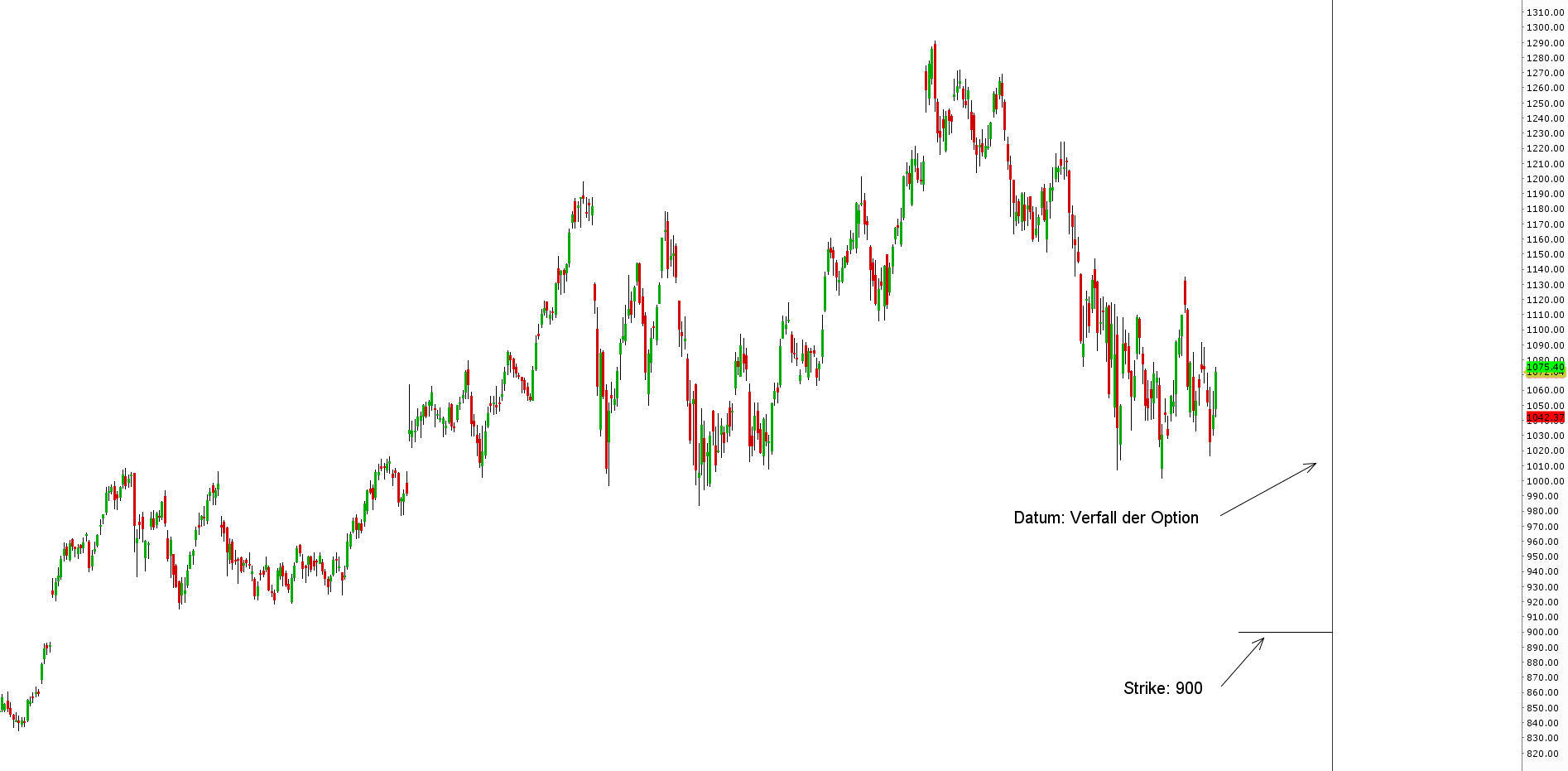

Let c be the call option premium s t be the stock price at the maturity of the option and k be the strike of the option. C csharp grpc core calloptions 30 beispiele gefunden. Set parameter id anr field w of number.

The example below show how to call a transaction and skip first screen when it in not possible to set. Michael here has also unfolded about the different parameters on which individual trading techniques are profitable. Example to call the prod order display transaction.

The strategy limits the losses of owning a stock but also caps the gains. A client can specify a url with this method or an asterisk to refer to the entire server. Sie können beispiele bewerten um die qualität der beispiele zu verbessern.

The goal is to call transaction with parameters and skip first screen. Call transaction co03 and skip first screen. Call and put option price formulas.

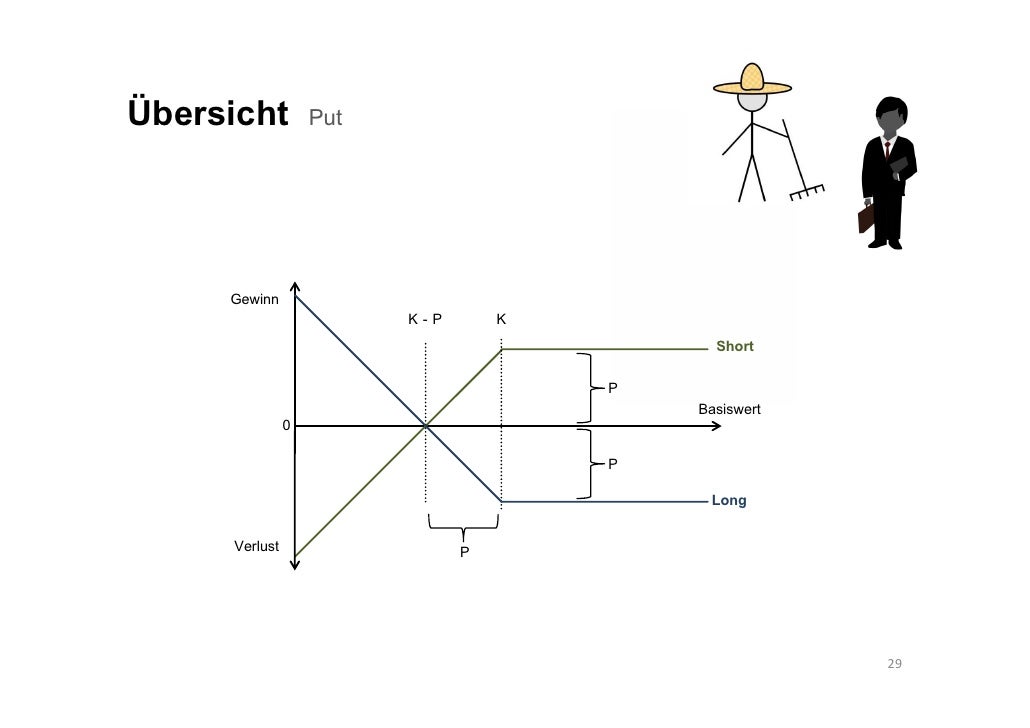

Dies sind die am besten bewerteten c csharp beispiele für die grpc core calloptions die aus open source projekten extrahiert wurden. The short call option payoff is then. Er kann also den bestimmten finanztitel zu einem heute festgelegten preis also dem basiswert kaufen bzw.

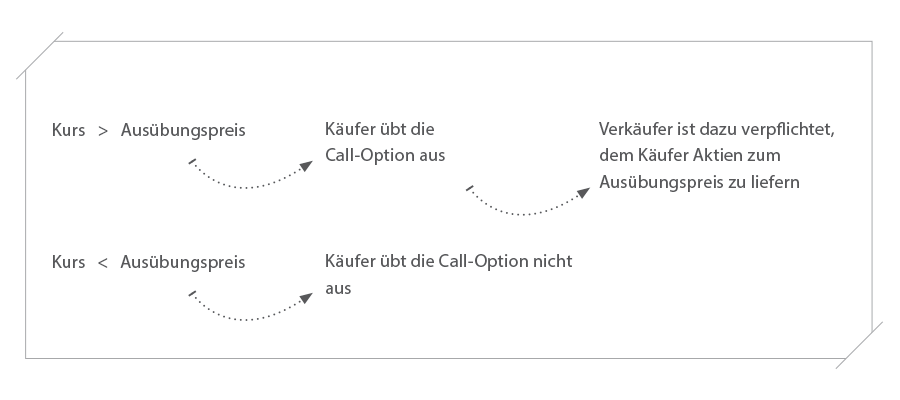

Max s t k 0 the short call. A bull call spread is an options strategy designed to benefit from a stock s limited increase in price. Die besonderheit bei optionen ist dass der käufer der option also der optionsnehmer später selbst wählen kann ob er sein optionsrecht ausübt oder nicht.

Call option c and put option p prices are calculated using the following formulas.